Digital Rollups

The Renewed Power of an Old Model

🔙 Background

The idea and execution of rollups has been around for a long time. Best known as a strategy for large corporates and private equity firms, a rollup is when an investor buys up companies in the same market and rolls them up together. Traditionally, this was done as a means of creating efficiencies across supply-side economies of scale.

Why does this make sense? Well, hypothetically, like the strategy of most consulting firms, synergies!

More recently, over the past three years, we have seen an explosion in Fulfilled-by-Amazon (FBA) companies, an Atlassian app rollup raising $100M, and UGC (User-Generated Content) experiences driving much of the value in the gaming ecosystem. Just in the past several months per Axios, we have:

Oct. 20: Perch — $123.5 million

Nov. 18: Heyday — $175 million

Jan. 11: Cap Hill Brand — $150 million

Feb. 9: Branded — $150 million

Feb. 10: Thrasio — $750 million

Feb. 17: Unybrands — $25 million

Feb. 25: Elevate Brands — $55 million

April 1: Thrasio — $100 million

On the surface, these industries have little to do with each other and might not share too many day-to-day qualities with their strategic predecessors. However, the one thing that does bind them is the rolling up of individual assets.

Whether you have a more traditional business or a crypto startup, networks and the ability to monetize them is becoming increasingly important. Moreover, rollups specifically are here to stay as part of the evolution of business models in part because of the ability to create demand-side economies of scale.

In order to explore the concept further, the format for the rest of this post will be:

The History of Rollups

Corporates

Private Equity

Digital Rollups

What are they?

Why now and what are their characteristics?

Examples of spaces that might be primed for rolling up

Conclusion

📜 History of Rollups

📈 Large Corporates

Perhaps the peak of rollups was during the 19th century era of robber barons - people like Andrew Carnegie (heavy industry), John D. Rockefeller (oil), and James Buchanan Duke (tobacco). If you're a student of history, you know these actions led to multiple anti-trust laws that are still in effect today.

In fact, HBR did a great job at describing the four cycles of Anti-Trust:

1900–1920. After initial administrative neglect and judicial hostility, this era ushered in the promise of antitrust with the breakup of Standard Oil and the enactment of the Clayton and Federal Trade Commission Acts to prevent the formation of trusts and monopolies.

1920s–1930s. Antitrust activity was rare since administrations generally preferred industry-government cooperation (and, during the early New Deal, economic planning and industry codes of fair competition), over robust antitrust enforcement.

1940s–late-1970s. Antitrust came to represent the Magna Carta of free enterprise – it was seen as the key to preserving economic and political freedom.

Late-1970s–mid-2010s. Antitrust contracted under the Chicago and post-Chicago Schools’ neoclassical economic theories.

While these anti-trust conversations still find themselves in the zeitgeist these days (see: conversations breaking up big tech) and M&A several decades ago was more focused on conglomeration, much of the activity these days is in fact not much of a rollup-type strategy at all. M&A is a very common tactic that many companies employ (with varying degrees of success) as means of breaking into another adjacent market or in lieu of R&D.

For example, many CPG exits are by the larger players buying up interesting brands in specific verticals that were a bit neglected. The smaller company gets a liquidity event and distribution, whereas the larger player essentially is financing its aforementioned R&D through acquisition. Relating to Digital Rollups, which will be described later, an interesting trend with CPG are startups/companies beginning with a rollup strategy as their market entry. Alanna Gregory did a great job laying that recently out here.

💵 Traditional Private Equity

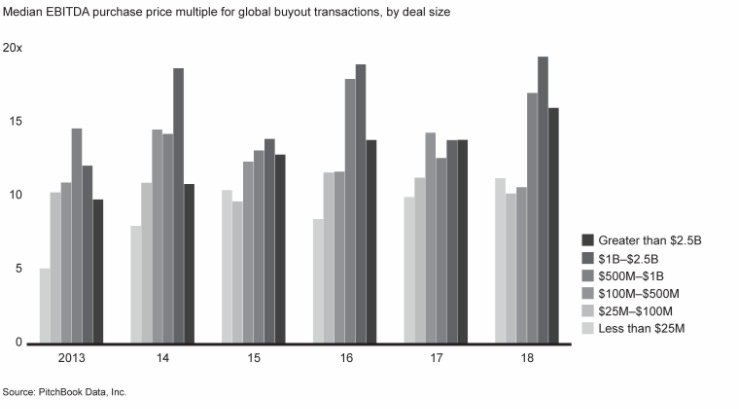

When Investcorp acquired Berlin Packaging, a container business, for ~$400M, supplementing it with four strategic acquisitions, and then seven years later selling that business to another Private Equity Firm for $1.4B at a 3X return, this strategy worked for several reasons that are all interrelated:

Aforementioned operation synergies ideally in businesses with growing markets

Strong execution on the part of the consolidator

Multiple Arbitrage (see below)

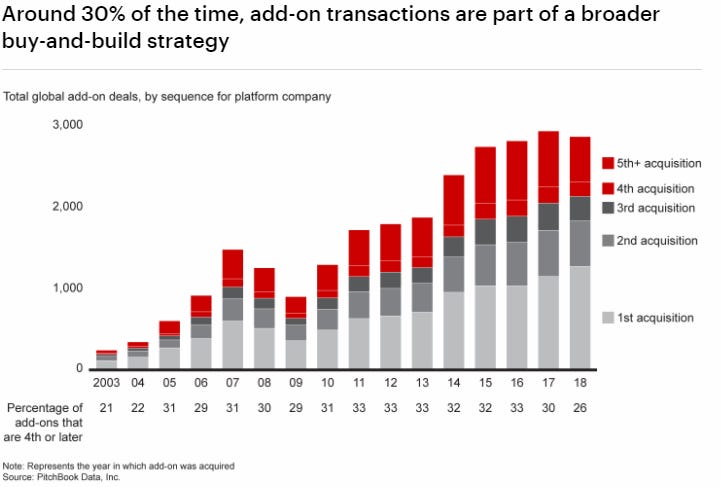

This relatively cookie cutter example from Bain Buy-and-Build is how most folks these days think of rollups. While the focus of this essay is not on PE strategy, some of the conceptual tenants apply to the Digital Rollups that is the focus of this essay.

💻 Digital Rollups

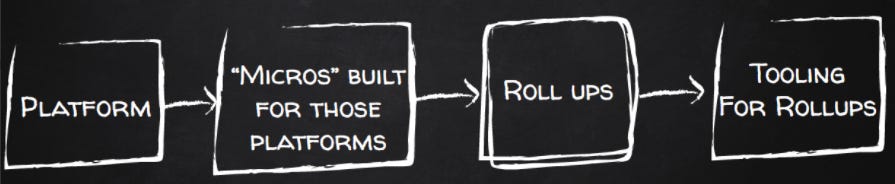

In order for these Digital Rollups to exist, there must first be a platform or platforms, broadly defined. Many of these are associated with marketplaces due the efficient nature of these services. Additionally, they have individuals in those communities building what I call "Micros." Depending on the case, these Micros can be applications, small DTC brands, or UGC games within universes.

As an example, in March 2021, Appfire raised $100M from TA Associates to continue buying up Atlassian Apps. This was after Appfire received $49M just last May from Silversmith, acquiring six companies in the Atlassian ecosystem (TechCrunch). The Atlassian product has had years to develop, and they built the product with applications in mind. Once the platform gained critical mass, it was only natural for value leakage to accrue from smaller apps built on top of Atlassian who do not have the luxury of demand-side economies of scale.

Around the same time as Appfire's earlier raise, Thrasio, the largest acquirer of Amazon business and one of the top 25 sellers on Amazon, raised $260M in its Series C, led by Advent International. Impressive in its own right until you realize that at the time this was the fastest U.S. profitable unicorn ever. The company is now worth $4Bn as of April 2021.

I'd imagine the concerns for Thrasio might have been "platform risk" or "market risk" since at the time the Amazon Third Party market was not as developed. Third-party sellers did $80B in revenue in 2020 and grew 50% from the previous year, and if anything, these platforms want to support their largest "developers."

Why Now and What are their Characteristics?

Why Now?

Rollups have to started expand beyond their traditional confines for three reasons:

Most importantly, while demand-side efficiencies were difficult to obtain historically, technology has aggregated demand in the same way that supply-side benefits are available for more capitalized entities.

Widgets/manufacturing/logistics -> Networks Effects

There are more opportunities for Digital Rollups because of the explosion in platforms that can and want to foster long-tail innovation.

Best practices have been learned from supply-side economies of scale rollups.

Characteristics

Markets with plenty of potential energy

Ideally has been catalyzed by some sort of inflection (i.e. belief, regulatory, adoption, or technology)

Platforms that are motivated to foster the long tail of innovation and that make the rollup an easier proposition

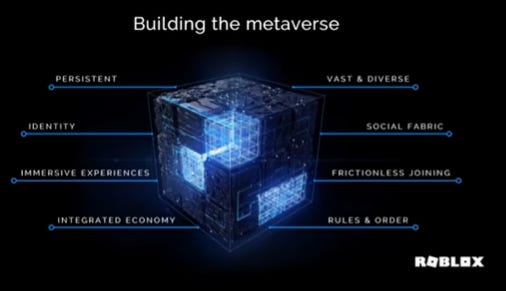

Companies like Amazon, Atlassian, Roblox, Shopify (Keith Rabois / Jack Abraham’s OpenStore), etc. that are both incentivized to facilitate optimal "user-generated" businesses and support their respective communities to help facilitate additional network effects.

Fragmented supply of "Micros"

Digital-first businesses, not necessarily digital-only

Applications of Digital Rollups

There will be new platforms and spaces for rollups that are hard to imagine. While the quick frameworks above will outlast an single opportunity, thought it might be interesting to point out some specific examples.

Right now, rollup candidates have been and could be found in the following industries/verticals, among many others:

👨💼 FBA/DTC/Small Businesses

Companies like Forum Brands, Moonshot Brands, and others are popping up to replicate part of Thrasio's playbook. Another example of this on a different scale is what we’ve seen in small business rollups; Scott Belsky, former CPO of Adobe and angel investor, called this reverse franchising.

An Approach -> Verticalized/international approaches to FBA/DTC businesses (some are now LatAm centric for example) and potentially those working cross platform (Amazon.. but also Shopify).

👩💻 Dev/No Code Apps

Aforementioned Atlassian example, but you can imagine this strategy playing out in any existing or burgeoning platform with thousands (and potentially millions) of apps.

🎮 UGC Gaming

A concept we came across recently is the explosion of UGC within the gaming universe. Not that different from No Code App platforms at the end of the day, these tools democratize what it means to be a game developer.

An Approach -> Rolling up current and future UGC games within larger worlds like Roblox, Minecraft, Valheim, etc.

🌐 Crypto

NFT

The long tail of these marketplaces have some interesting assets, but you have to imagine most of them will fail because of distribution difficulties.

An Approach -> More of a wait and see, but the hypothesis could be to rollup the niche plays that are interesting but could not get off the ground. Creation upon destruction.

Ethereum

What I’m most excited about is rollups!

- Vitalik Buterin on Tim Ferriss’ podcast

Could not pass up the opportunity to include this quote even if this example is a little more tongue and cheek. Vitalik is speaking about a scalability solution for Ethereum called “Rollups,” which he describes in this post on his website. He describes the technology as “Rollups [moving] computation (and state storage) off-chain, but [keeping] some data per transaction on-chain.”

In many ways, Digital Rollups are doing the same. Much of the work is being done at the asset-level, even if there is an important linkage back to the main system.

🤹 Creators

While a bit different than most digital businesses, there are several opportunities for creators or creator communities to come together in a next gen agency model - perhaps one with more modern governance and incentives.

💸 Venture

Another one a bit more removed from digital at first glance, venture itself is being disrupted. Firms that stand pat will most likely get disrupted themselves. What AngelList is doing with Rolling Funds or Roll Up Vehicles are attempts to essentially more directly monetize both the "GPs" and the "LPs" and their network. Most (99%+) of these vehicles will fail by nature of the power law, but the trend they represent is very real.

An Approach -> What Cendana Capital is doing by investing in seeding micro funds is intriguing. Allocation is much easier to obtain when check sizes are small, and first time funds generally outperform subsequent ones before fund size creep/allocation and network degradation can be more of a concern.

🔨Tooling

Another opportunity of note is the tooling for these rollups. Mayanalytics is one such company working in the FBA space built by one of the early employees of Thrasio.

Will not spend as much time here since time will tell whether there will be enough platform communities that are large enough to support $B outcomes, but there is an opportunity in certain markets (FBA as an example) where the market is so large that they might exist.

The more likely possibility are hybrid rollups where the rollup is taking an equity stake while providing services to support said businesses, similar to some trends we have seen to all capital allocators in the private markets.

Conclusion

Conventional wisdom in the tech community has been to build one company with one killer use case and expand beyond said use case. This heuristic is still probably true.

In a topic for another post, if you reimagined every company just being a network (as we have seen with the crypto boom), you begin to reframe what it means to build anything. This classic business model has new applications now that we have the long tail of Micros built on top of large platforms. Instead of only building business models, you start to think through creating “network models.”

Time will tell if other business will follow this trend and framework, but it has become apparently this is not just a tool for large companies and buyout firms.

Would welcome any feedback at leeor@floodgate.com. Thanks to everyone at Floodgate (Mike, Ann, Arjun, Iris, and Shawn) and some others (Alexa, Barr, Levine, Dan M, Sam P, Vik, Will B, Krey) who helped me think through this one! It takes a village.